Terminology is a specific language that every profession has. Forex terminology is the unique language within this market. For newcomers to Forex, understanding all these terms can be very challenging. Therefore, today, I will list the basic terms that are commonly used for you.

>>>Tổng hợp bài viết

Currency Pair

The first term you need to understand is the “currency pair.” The reason it’s called a “pair” is that Forex trading is conducted using currency pairs instead of individual currencies as in traditional transactions. Generally, a currency pair is a financial instrument used for trading on the Forex market. There are currently three common types of currency pairs: major currency pairs, cross-currency pairs, and exotic currency pairs.

Major Currency Pairs

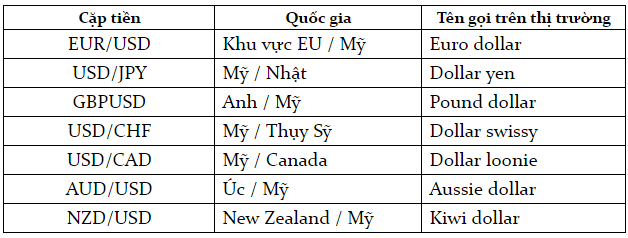

Major currency pairs usually have high liquidity and are widely traded. Typically, pairs that include the USD are commonly traded worldwide.

Examples: USD/JPY (U.S. Dollar/Japanese Yen), USD/CHF (U.S. Dollar/Swiss Franc), EUR/USD (Euro/U.S. Dollar), GBP/USD (British Pound/U.S. Dollar), etc.

Cross-Currency Pairs

Besides major currency pairs, cross-currency pairs (crosses) also attract much attention. These financial instruments can yield significant profits if traders seize the right moment.

Most cross-currency pairs are based on three currencies: EUR, JPY, GBP, and do not include the USD. Here are some examples of cross-currency pairs:

Exotic Currency Pairs

Exotic currency pairs are less commonly used. The reason is that they have lower liquidity and are often more volatile. Exotic currency pairs include one major currency and one currency from an emerging economy, such as the currency of India, Brazil, or Mexico.

Pip

Understanding the unit Pip is essential for smooth trading and profit calculation. A Pip is a unit used to measure the price movement of a financial instrument (currency pair). Most currency pairs have four decimal places, and the Pip corresponds to the fourth decimal place. For example, if the price changes from 14.0000 to 14.0001, it means the price has increased by 1 Pip.

Lot

A Lot is the trading volume of a currency used in Forex trading. The standard size of 1 Lot is equivalent to 100,000 units of the base currency. Additionally, there are Mini Lots equivalent to 10,000 units and Micro Lots equivalent to 1,000 units of the base currency.

Ask Price

For example, if the EUR/USD currency pair is quoted at 1.2812/1.2815, the Ask Price is 1.2815. If you want to buy this pair, you will need to pay the price of 1.2815 to execute the order.

The Ask Price is the amount you must pay when you want to buy a currency pair. In other words, this is the price at which the market offers the currency to traders. In trading accounts, this price always appears after the Bid Price.

Bid Price /h3>

The Bid Price is the amount you receive when you sell a currency pair to liquidity providers. This is the price that banks, funds, or exchanges will accept to buy from you.

For example, if the GBP/USD currency pair is quoted at 1.8812/1.8815, the Bid Price is 1.8812. This means that if you want to sell this currency pair, the market will buy it back at the price of 1.8812.

Spread

After understanding what Bid and Ask prices are, it becomes easier to grasp the concept of Spread. The Spread is the difference between the Ask Price and the Bid Price. This is the fee charged by the exchange from traders to maintain the trading platform. The formula to calculate the Spread is:

Spread = Ask Price – Bid Price.

For example, if the EUR/USD currency pair is quoted at 1.1160/1.1161, where the Ask Price is 1.1161 and the Bid Price is 1.1160, applying the formula above, Spread = 1.1161 – 1.1160 = 1 Pip.

Commission

Commission is a term used to refer to the fee that traders must pay to the exchange for each trade opened and closed. The typical commission fee charged by exchanges ranges from $7 to $10. Some exchanges even reduce the commission fee to zero to attract investors.

In addition to the Spread, the commission fee is also a concern for many traders, as it significantly affects the profitability of each trade. This fee is particularly impactful for traders who follow the scalping trading style.

Swap

The overnight fee (swap) can be simply understood as the interest that traders receive or pay when holding a position overnight. This fee only occurs when the trader holds a position overnight. Additionally, the interest rate of the currency sold must be higher than the interest rate of the currency bought to generate a profit.

If you are a long-term investor, you can take advantage of the swap fee to earn profits. When trading overnight, investors should note that every Wednesday, the swap fee triples. By selecting a positive swap at this time, traders can earn three times the fee.

Margin

Margin is the amount of money that traders must deposit with the exchange to be allowed to execute trades. The margin amount depends on the margin ratio and the trading volume of the investor in the market.

Leverage

Financial leverage is a tool that allows traders to execute larger trades than their current capital. Accordingly, exchanges will lend money to traders to carry out transactions after sufficient margin has been deposited. Currently, the popular leverage ratios supported by exchanges range from 10:1 to 2000:1.

For example, if you want to buy 1 Lot, you would need $100,000, but your account only has $1,000. By using leverage of 1:100, you can trade 1 Lot.

Margin Call

A Margin Call is a warning that alerts traders when their trading account enters a danger zone. This also means that some or all of the trades may be closed. To prevent account closure, when a margin call occurs, the investor needs to add more funds to the account or close part of the losing position.

Khoảng trống GAP

In Forex price charts, you may sometimes see gaps between two trades, known as GAP. GAP refers to the gaps that occur when the price moves too sharply, either rising or falling significantly, causing the price to jump (up or down) higher or lower than the closing price of the previous candlestick. A price jump upwards is called a GAP up, while a downwards jump is called a GAP down.

GAPs typically occur in the following situations:

- Early Monday, as the Forex market is closed on Saturdays and Sundays, and any shocking news released over the weekend can create a price gap.

- GAPs also appear during holidays such as New Year’s or Christmas when the market is closed for an extended period, and currency exchange demand increases during these times.

- When there is shocking news that affects the financial market, causing banks to liquidate foreign exchange, it can also create a GAP.

Entry Point

The most important aspect of Forex trading is determining the correct entry point. This factor directly affects your profit or loss after each buy/sell transaction.

The term entry point refers to the point at which traders begin to execute a buy or sell trade.

Long and Short

Long and short are basic terms in the Forex market. “Long” means buying, and “Short” means selling. In essence, Long and Short refer to the buying and selling activities of traders as well as other liquidity providers.

Broker

A broker is usually an individual or a company that acts as an intermediary between buyers and sellers of currency pairs. In the Forex market, brokers are the brokerage firms. To sustain their operations, they charge fees such as commissions and spreads from traders.

Trading Platform

A trading platform, also known as a trading terminal, is software that investors use to execute trades. Additionally, it is a tool that helps traders manage their accounts, analyze the financial market, and receive the latest information.

Most trading platforms today support trading on websites or can be downloaded to mobile phones or computers for easier trading. Some popular Forex trading platforms include MT4, MT5, cTrader, etc.